Format Draft ECB Loan Agreement

June 18, 2019 by Team Instabizfilings

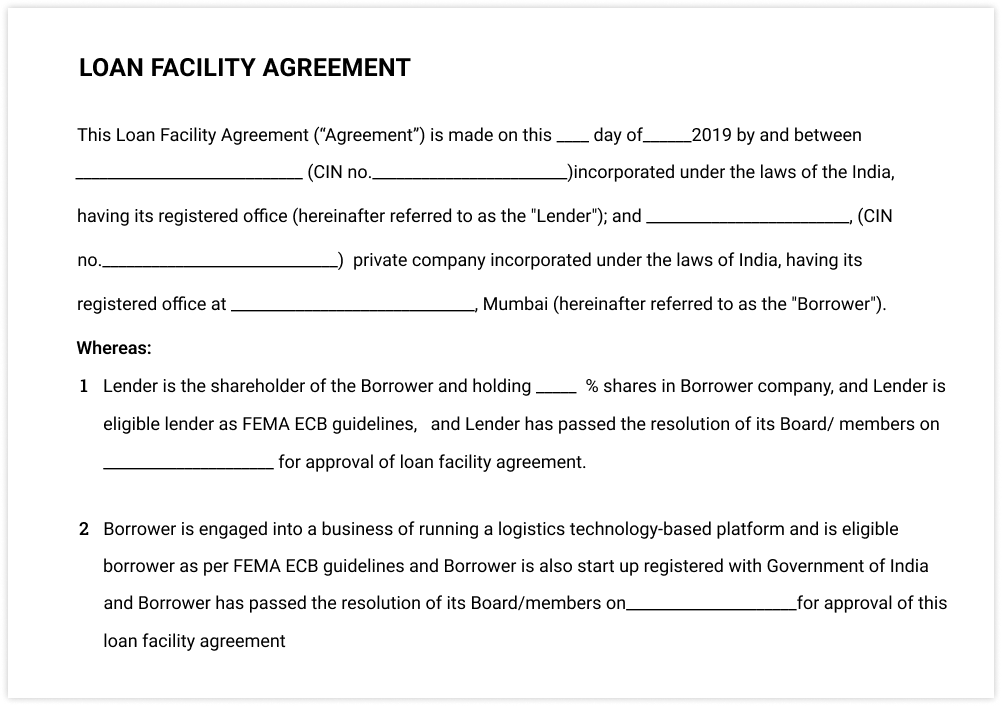

Below given is the draft - ECB Agreement

SAMPLE 1

IT IS AGREED as follows:

- Definitions:

In addition to the terms defined elsewhere in this Agreement, unless otherwise specifically provided herein, the following terms shall have the following meanings for all purposes when used in this Agreement and in any notice or other document delivered in connection with this Agreement:

- “Advances” shall mean any loan or advance of credit from the Lender to the Borrower pursuant to this Agreement.

- “Agreement” shall mean this Loan Facility Agreement, as amended or supplemented from time to time. "

- Business Day" means a day (other than a Saturday or Sunday) on which banks are open for general business in London.

- “LIBOR” means the London Inter-Bank Offering Rate as determined by the British Banking Association

- “Event of Default” shall have the meaning ascribed to it in Clause 9.

- “Interest Period” shall mean with respect to each Advance

- “Loan” shall mean all Advances outstanding hereunder or made to the Borrower by the Lender pursuant to Clause 2 of this Agreement.

- “Maturity Date” shall, for each Advance, mean the date falling 5 years after the date of each Advance under this Agreement or such later date as the parties may agree in writing, which shall be no later than 31 December 2024

- “Maximum Credit Amount” shall mean USD _______ Million (_________ million,).

- “RBI” shall mean Reserve Bank of India.

- The Loan Facility

-

- Subject to the terms and conditions hereof, the Lender shall make such advances of credit in INR equivalent to US Dollars to the Borrower as the Borrower may from time to time request (each, an “Advance”) by notice to the Lender provided, however, that: (a) the aggregate of all Advances outstanding and requested at any time shall not exceed the Maximum Credit Amount, (b) no Event of Default, and no event which, with the giving of notice or lapse of time, or both, would become an Event of Default, has occurred and is then continuing, (c) the proceeds of each Advance will be used for the purpose of expansion of existing facilities / working capital and corporate purpose. The Borrower has obtained all necessary regulatory approvals, if any, that may be required for the purposes of availing itself of the loan facility under this Agreement.

- Requests for Advances

-

- Each request for an Advance under Clause 2 shall be in writing or by electronic mail and executed by an authorised representative of the Borrower, specifying the amount of that Advance.

- Subject to the provisions of paragraph 3.3 below, each Advance shall be made as soon as possible but not later than on the second Business Day after the Lender receives a duly completed request for an Advance or such other date as the parties may agree.

- Each request for an Advance shall constitute a representation and warranty by the Borrower to the Lender that all representations and warranties contained herein were true and accurate when made, and are true and accurate on the date of such request, and that no Event of Default, and no event which, with the giving of notice or lapse of time, or both, would become an Event of Default, has occurred and is then continuing.

-

- Interest

-

- The Borrower will pay interest on each Advance at a rate equal to LIBOR + 450 % bps spread, or the maximum interest rate payable under applicable law, for that Interest Period.

- Interest shall be calculated on the basis of the actual number of days elapsed of a month of 30 days and a year of 360 days.

- The Borrower will pay interest in respect of each Advance within seven working days from the expiry of the respective Interest Period.

- Use of Proceeds

- Except as the Lender may otherwise agree in writing, the proceeds of the Advances shall be used by the Borrower for the purpose of expansion of existing facilities and working capital facilities, and corporate purpose. The Borrower shall not, directly or indirectly, use any part of the proceeds from any Advance for any purpose which would violate, or cause the Lender to be in violation of, any provision of any applicable statute, regulation, order or restriction.

- Payment and repayment and cancellation

- Each outstanding Advance hereunder shall be repaid in full (including any interest which has not yet been paid and which shall be calculated on a time apportioned basis) following the giving of not less than three months written notice by the Lender to the Borrower provided the repayment is not before the respective Maturity Date for the Advance.

- The Borrower may, subject to the prior approval of the RBI and as per the provision of FEMA guidelines related to Overseas Direct Investment (ODI), make prepayments to the Lender in respect of any outstanding Advance prior to its respective Maturity Date on any Business Day without premium or penalty.

- The Borrower may, subject to notification to the RBI, cancel the whole or part of the undrawn amount under this Agreement on giving notice to the Lender.

- Rank of Obligations

- All indebtedness under this Agreement is a direct and unsecured obligation of the Borrower and will at all times rank at least equally and rateably with all its other unsecured and unsubordinated indebtedness for borrowed money except for such indebtedness preferred by mandatory provisions of law.

- Taxes and deductions

- All amounts payable by the Borrower under this Agreement shall be made in INR into such bank account as shall be indicated by the Lender. All such amounts shall be paid in full without set-off, counterclaim or any suspension, restriction or condition and free and clear of any present or future deductions of any nature (except to the extent required by law or regulation).

- If the Borrower is required by law to make any deduction or withholding from amounts due under this Agreement in respect of taxes, the Borrower shall pay the full amount required to be deducted or withheld to the relevant tax authority within the time limit allowed for such payment under the applicable law. The Borrower shall deliver to the Lender within 30 days after it has made such payment a certificate evidencing the amount deducted or withheld.

- If the Borrower is required by law to make any deduction or withholding from amounts due under this Agreement in respect of taxes, the Borrower shall indemnify the Lender against the deduction or withholding from amounts due under this Agreement by paying to the Lender, at the time that the payment to the Lender is due, an additional amount that ensures that, after the deduction or withholding is made, the Lender receives a net sum equal to the sum it would have received if the deduction or withholding had not been made.

- Events of Default

- Any one of the following events shall constitute an event of default (each, an “Event of Default”) under this Agreement: (a) a petition for bankruptcy is filed concerning the Borrower, the Borrower files a request for the suspension of payments, or files for its own bankruptcy; (b) a decision to dissolve or liquidate the Borrower is taken or such dissolution is ordered by a competent court or other authority; (c) the Borrower is in breach of any obligation under this Agreement which breach, if capable of remedy, is not remedied within 10 days of receipt by the Borrower of a notice in writing to that end; (d) the Borrower compounds with its creditors or has receiver appointed for all or any of its assets, or takes or suffers any similar action in consequence of its debt.

- Subject to applicable statute, regulation, order or restriction, upon the occurrence, and during the continuance, of an Event of Default, the Lender (at its election) may declare all of the sums outstanding under this Agreement (including any outstanding Advances and interest which has not yet been paid and which shall be calculated on a time apportioned basis) immediately due and payable, whereupon such sums shall be forthwith due and payable and the right to borrow hereunder shall terminate. In the event such sums become so due and payable, the Lender may proceed to enforce payment of them in such manner as it may elect and may exercise any and all of its rights and remedies, whether hereunder or under applicable law.

- Notices

- Any notice under this Agreement shall be in writing. Any notice to be sent to either party shall be sufficiently served if sent to it by registered mail to the registered office address of the relevant party as set out at the beginning of this Agreement.

- Entire Agreement

- This Agreement and the documents and other materials contemplated hereby constitute the entire agreement of the Borrower and the Lender and express their entire understanding with respect to credit advanced or to be advanced by the Lender to the Borrower.

- Counterparts

- This Agreement and amendments to it may be executed in several counterparts, each of which shall be an original. The several counterparts shall constitute a single Agreement.

- Invalidity

- In the event that any of the provisions of this Agreement may be invalid or unenforceable, the parties hereto shall procure that such invalid or unenforceable provision shall be substituted by another provision which is valid and enforceable and which reflects to the extent possible the original intention of the parties.

- Amendments

- This Agreement or any provision hereof can only be amended in writing signed by each of the parties.

- Costs

- Each of the parties shall bear its own normal costs in connection with this Agreement.

- Governing Law

- This Agreement shall be governed by and construed under the laws of India.

- Jurisdiction

- The parties to this Agreement hereby submit in respect of any suit, action or proceeding arising out of this Agreement to the jurisdiction of the courts of India.

IN WITNESS WHEREOF, the Borrower and the Lender have entered into this Agreement on the date set forth at the beginning of this Agreement.

|

For ______________________________ (Borrower)

Director Authorized by Resolution passed on______ Witness for Borrower Name: Address |

For_______________________________ (Lender)

Director Authorized by resolution passed on_________ Witness for Lender Name Address:

|

Disclaimer

The information provided in this blog is purely for general informational purposes only. While every effort has been made to ensure the accuracy, reliability and completeness of the content presented, we make no representations or warranties of any kind, express or implied, for the same.

We expressly disclaim any and all liability for any loss, damage or injury arising from or in connection with the use of or reliance on this information. This includes, but is not limited to, any direct, indirect, incidental, consequential or punitive damage.

Further, we reserve the right to make changes to the content at any time without prior notice. For specific advice tailored to your situation, we request you to get in touch with us.

Need more details? We can help! Talk to our experts now!

Start Your Business Registration – Talk to Our Experts Now!

Still Confused?

Talk to experts? Fill in the information and we will reach out in 24 Working Hours.