One Person Company Registration in India

Fast, Reliable and Government-Compliant OPC Registration

Launch Your OPC the Right Way

Structured and Transparent Process

Expert Guidance on MCA and ROC Filings

Trusted OPC Registration Specialists

The OPC Registration in India was started as a concept under the Companies Act, 2013 which has the following features, a single person can form a company like a sole trader and also has all the features of a company.

The rationale for the introduction of one-person companies was to spur small business, and to legalize the MSME business entities. Concerning the legal obligations, current Indian Companies Act 2013 indicates that it is possible to establish a company with the minimum of one director and one member, but it is more interesting that the director and the member can be one person. Hence, One Person Company Registration is one of the possibilities to create a limited liability company in India for one person. This is the criteria and steps which are followed for registration of one person company.

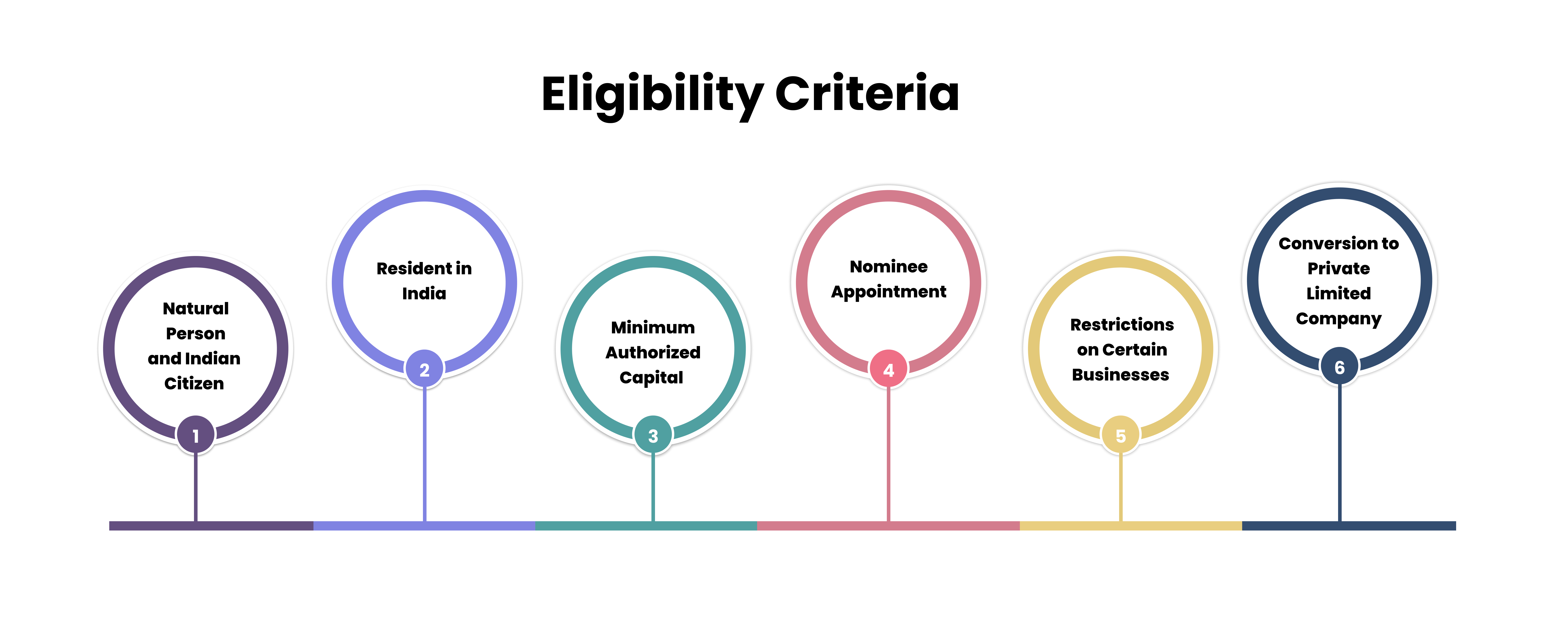

But before going for the OPC registration process, it is imperative to know the OPC formation process, requirements, and many other restrictions that accompany the OPC formation. This legal act contains very clear provisions that have to be met to be sure that the individual who provides the notification of the OPC meets the necessary requirements.

Legal Status: An OPC obtains a distinct legal personality, which benefits the particular person, who began the firm, since that particular individual is shielded from liability for the company’s losses.

Easy Fundraising: As OPCs are private entities they are in the position to organise funds from Venture Capitalists, Angels and Banks which proprietorship firms cannot do.

Reduced Compliance: With regard to the structural aspect, similar to the previous one, OPCs are provided with an exclusionary treatment in the occurrence of certain legal regulations of the Companies Act, 2013 due to the simplified administration responsibilities.

Simple Incorporation: It is in a dimension to be annexed at one package, one nominee and the said single member is the director. This form of business does not have a ‘paid-up capital hence, the incorporation of this type of business is easier.

Efficient Management: Since OPC is being handled by one person, there is quick decision making; this will minimize on the management issues that may affect the performance of the company while at the same time eliminating on conflicts that takes alot of time in making the most important decisions.

Perpetual Succession: OPCs have an aspect of perpetual succession; this implies the company will continue to exist even when it is just counting a single member.

In other words, OPCs have certain advantages, namely no or negligible liability, general overview in fundraising, less paperwork and regulations, simple formation and management of an OPC company and perpetual succession.

While OPCs offer advantages, there are also limitations:However, OPCs are not without limitations also:

Suitable for Small Businesses: The question is, OPCs are mainly suitable for small businesses because the latter can only join one. This in turn limits its ability to come up with more funds to fund new projects as the firm expands or where necessary in funding of new projects.

Restriction on Business Activities: But in case of OPCs there are restrictions regarding the nature of the activities that the company can pursue such as Non-banking financial investments and Charitable objects only. Therefore, the specific business activities in these directions are forbidden for the companies which can register an OPC company.

Ownership and Management: As for the ownership and management structures, OPCs do not make a split between the two because the sole member could also be the director. On this basis, it may lead to ethical dilemmas or concerns as to conflict of interest.

In the process of OPC for India, the government has included a new form name that is SPICe+ ( SImplified Proforma for Incorporating Company Electronically Plus) for the replacement of previous forms for the incorporation of OPC company.

The OPC Registration process consists of two parts:The OPC Registration process covers the following two processes:

Part A: Hence, the first part of the SPICe+ form is concerned with the name approval of the company proposed and application for DIN or PAN for the proposed director.

Part B: The subsequent part called Part B is to offer incorporation related information. Here is information sharing including the share capital, the details of the director of the OPC and even the information regarding the shareholder together with the OPC registered office address.

The following steps fund the registration of OPC Online.

Several essential documents must be prepared and submitted to the Registrar of Companies (ROC) as part of the One Person Company registration process:The following documents are required to be drafted and the filed with the (ROC) for the registration of One Person Company:

Memorandum of Association (MoA)

Articles of Association (AoA)

The nominee’s consent shall also be attached along with Form INC-3 and PAN card and Aadhar card of the nominee.

Proof of Registered Office

In this context, form INC-9 concerning the proposed director together with the declaration should be accompanied by the DIR-2 containing the consent in relation to the proposed director.

A written declaration by a legal practitioner concerning certain matters or actions, to the effect that such has been done as or in the manner or to the extent demanded by the LAW concerning a cause of action.

The following are basic and should be easily provided at the time of OPC registration of the firm.

If you want to register an OPC company, then Instabiz Filling is a perfect choice. Our expert team has helped countless entrepreneurs set up their businesses. We can guide you through the entire process, from obtaining the necessary documents to obtaining the Certificate of Incorporation.

Here are some reasons why you should choose us for your OPC company registration:

In short, we are committed to providing hassle-free and seamless OPC company registration and Private Limited Company and LLP registration experience. Contact us today to begin your entrepreneurial journey!

Ready to start your own business? Explore our guide on One Person Company registration, covering everything you need to know for a smooth process.

One Person Company registration is the process of incorporating a company with a single owner under the Companies Act, 2013 in India.

Only an Indian citizen and resident can register a One Person Company in India.

An OPC requires one director, one shareholder, a nominee, and a registered office address in India.

Documents include PAN and Aadhaar card, address proof, passport-size photograph, and registered office address proof.

The cost of OPC registration starts from ₹6,499 and may vary depending on government and professional fees.

OPC registration usually takes 7 to 10 working days, subject to document verification and approvals.

Yes, appointing a nominee is mandatory for One Person Company registration.

Yes, an OPC can be converted into a Private Limited Company after fulfilling the prescribed conditions.

Yes, OPC registration can be completed entirely online with professional assistance.

Instabiz Filings offers expert support, transparent pricing, and end-to-end assistance for OPC registration.