Benefits of Private Limited Company

November 19, 2025 by Team Instabizfilings

Introduction

The best organizational scheme to offer in commencing operation in India would be owned by private limited business establishment. Private limited companies provide shareholders protection from personal obligations yet operate under unique ownership regulations.The registration process for a private limited company creates clear boundaries between company directors and shareholders.

Through our cost-competitive solution Instabiz Filings provides new company registration along with comprehensive private limited company registration assistance across India. Our staff makes sure to work with all the documentation necessary and passes all checks by the Ministry of Corporate Affairs (MCA).

Advantages of a Private Limited Company

An Incorporation of Private Limited Company represents one of India's most active forms of business structure. This system comes with several pros and cons, and we will examine here.

-

Limited Liability: Subject to their capital investment shareholders bear no more liability than their actual contribution which preserves their personal assets from company debt and legal obligations.

-

Distinct Legal Identity: A Private Limited Company moves through life with legal standing that differs completely from what its owners possess. The company enjoys distinct legal status that allows it to own assets along with the ability to make contractual agreements while simultaneously taking legal action under company name.

-

Continuous Existence: The operational continuity of a company remains unchanged by changes in its shareholder base or directorial staff. A Private Limited Company maintains perpetual legal identity which does not terminate from the lives of its members.

-

Ease of Funding: A company faces straightforward capital generation through issuing shares to investors along with venture capitalists and angel investors. This structure attracts external investment. Entrepreneurial concern about capital reduces significantly after startup through this business structure.

-

Tax Benefits: Private Limited Companies benefit from multiple tax advantages and exemptions because they operate as efficient tax entities.

-

Credibility and Trust: The application of language in the company name using Pvt. Ltd. makes your business gain even greater consumer confidence, and affinity with the supply chain.

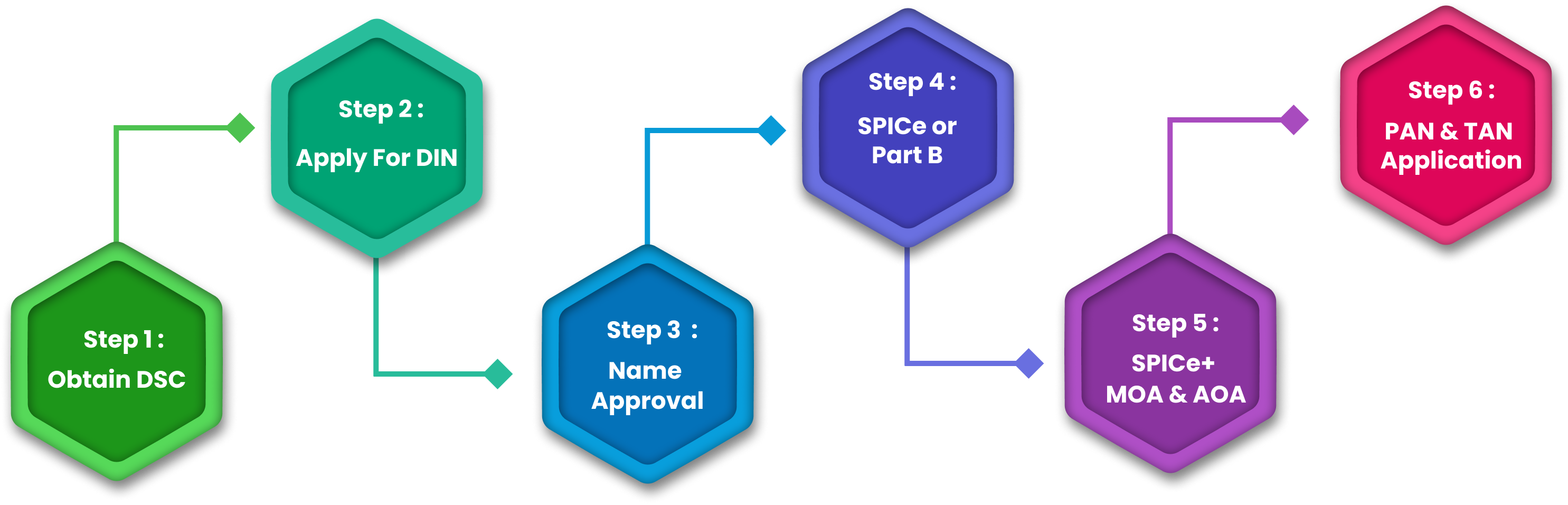

Company Registration Process

The company registration process in India follows a simple four-step system which users can easily complete:

Step 1: A company which intends to operate should have Digital Signature Certificate (DSC)

-

The directors, shareholders who run the business of the companies are compelled to purchase the Digital Signature Certificates (DSC) with the Controller of Certification Agencies (CCA). Fundamental registration information must be supplied to the authorities which includes passport photos and your PAN details together with Aadhar Card information and phone number and email address. Foreign nationals need to provide both notarized and legally stamped documents for the application process.

Step 2: Director Identification Number (DIN)

-

Before taking up the role of company director you must obtain a Director Identification Number (DIN). The process of registration obliges all directors to obtain and enter a DIN.

Step 3 The Company (SPICe+ Part A) Application Functions as a Name Reservation system

-

The company's distinct name needs to be secured through the SPICe+ Part A document system. To register the company users must select the business format and classification followed by picking the appropriate categories and subclasses while declaring the key industrial operation. Two potential names require your submission for approval during the application process.

Step 4: The SPICe+ Part B form requires submission of all the information about the company

-

Company registration in India requires users to supply full details regarding capital structures and stamp duty payments as well as PAN and TAN applications together with necessary supporting documentation and subscriber and director information and chosen office address.

Step 5: Companies must create and submit two documents containing company specifications to the MCA through SPICe+ MOA and AOA

-

Create the essential company details in draft format for your MOA along with AOA. The MCA needs signed digital documents from subscribers along with professionals before they can approve these submissions.

-

Business members need to file the AGILE-PRO-S form to initialize their registration for GST and EPFO and ESIC as well as establishing a bank account while getting a shop and establishment license depending on state regulations.

-

Successful businesses will be given Certificate of Incorporation (COI) having Company Identification Number (CIN), PAN and TAN by the MCA.

You must complete these standard procedures to establish a company successfully within India.

Private Limited Company registration fees & cost

Fees breakup for Private Limited Company registration (example up to ₹1,00,000 authorised capital)

| Cost component | Amount (₹) | Notes |

|---|---|---|

| Professional fees – Starter Package | 8,999 | Includes name approval, DSC (2), DIN (2), MOA, AOA, incorporation, PAN, TAN. |

| Estimated government fees (MCA, ROC) | 2,500 | For basic authorised capital of ₹1,00,000 (varies by state & capital). |

| GST registration (if opted) | 0 | Complimentary in Growth Package. |

| MSME registration (if opted) | 0 | Complimentary in Growth Package. |

| Trademark application (if opted) | Professional: 0, Govt: as per class & entity | Professional fee covered in One Stop Package; govt fees extra at actuals. |

Final pricing may vary depending on your authorised capital, state of registration and any additional registrations or add‑on services selected.

Disclaimer

The information provided in this blog is purely for general informational purposes only. While every effort has been made to ensure the accuracy, reliability and completeness of the content presented, we make no representations or warranties of any kind, express or implied, for the same.

We expressly disclaim any and all liability for any loss, damage or injury arising from or in connection with the use of or reliance on this information. This includes, but is not limited to, any direct, indirect, incidental, consequential or punitive damage.

Further, we reserve the right to make changes to the content at any time without prior notice. For specific advice tailored to your situation, we request you to get in touch with us.

Need more details? We can help! Talk to our experts now!

Start Your Business Registration – Talk to Our Experts Now!

Still Confused?

Talk to experts? Fill in the information and we will reach out in 24 Working Hours.