All companies registered in India like Private Limited Company, One Person Company, Limited Liability Partnership Company, and Section 8 company must file their Annual filing forms each year i.e Form AOC-4 and Form MGT-7 with Ministry of Corporate Affairs (MCA).

A copy of Financial Statements (including Consolidated Financial Statements in case of holding company), shall be filed with Registrar of Companies (ROC) within 30 (Thirty) days from the date when the accounts were duly adopted at the Annual General Meeting (AGM) of the Company in Form AOC-4.

Every company shall file with the Registrar of Companies (ROC) a copy of the Annual Return, within 60 (sixty) days from the date on which the Annual General Meeting is held with the ROC in Form MGT-7.

1. Preparation of Basic Directors Report

2. Preparation of e-forms AOC-4

3. Preparation of e-form MGT-7;

4. Arranging for Certification of e-forms;

5. Filing of forms with ROC.

One Person Company (OPC) is the latest form of business entity that has been allowed in India where one man can form a company. This idea is especially helpful for people who run a business alone but wish to incorporate, not needing several shareholders. The following is a calendar of filing schedules of the OPC for the year.

An OPC initially must submit the following documents and forms every year with the Registrar of Companies (ROC):

Financial Statements (AOC-4)

Annual Return (MGT-7 Form)

Income Tax Return (ITR)

Form DIR-3 KYC

Form ADT-1 (if applicable)

Content: They include the balance sheet, profit and loss account, cash flow statement if any, auditor’s report and the board report.

Due Date: AOC-4 needs to be filed within 180 days from the end of the financial year that is by 27th September.

Attachments:

Balance Sheet

Profit and Loss Account

Auditor's Report

Any other relevant documents

Content: Guided by the information given, annual return contains data about the company’s shareholders, directors and any alterations made throughout the year.

Due Date: MGT-7 has to be filed within 60 days of filing for passing the AGM For OPCs it is not necessary to hold the AGM but filing of the return is mandatory within 180 days from the closing of the financial year.

Certification: While submitting an MGT-7 form the OPC doesn’t need to be certified by a Company Secretary (CS) if its paid up capital is less than fifty lakh or turnover is less than two crore.

Form: ITR-6 is the form that is filled by companies which include OPCs.

Due Date: In most of the situations, the date to file the ITR is 31st July if the person is not eligible for tax audit and 30th September if he is otherwise eligible.

Tax Audit: An OPC has to get his accounts audited if the turnover of the company in the financial year is exceeding INR 1 Crore.

Content: Form DIR-3 KYC includes the personal details of the director of the company which includes PAN, Aadhaar, contact detail etc.

Due Date: It could be noted that the form has to be filed annually before September 30th.

Penalty: The failure to file DIR-3 KYC is well accompanied by a penalty of an amount equivalent to INR 5,000/-

Content: This form is used for communication to the ROC about the appointment of an auditor.

Due Date: Where the auditor is appointed this form must be filed within 15 days after the AGM.

Note: There is, however, a requirement to file this return only in the period when there is a change in the auditor.

AGM: Of particular note is that OPCs have no legal requirement to convene and conduct an AGM. However, there is a requirement that the above stated financial statements are signed and by the sole director and filed at the stated dates.

Books of Accounts: It is mandatory for OPCs to keep and maintain their books of Account and get them audited at least once in a year.

Late Filing Fees: Consequently, ROC fines any company submitting its AOC-4 and MGT-7 after the statutory deadline INR 100 daily.

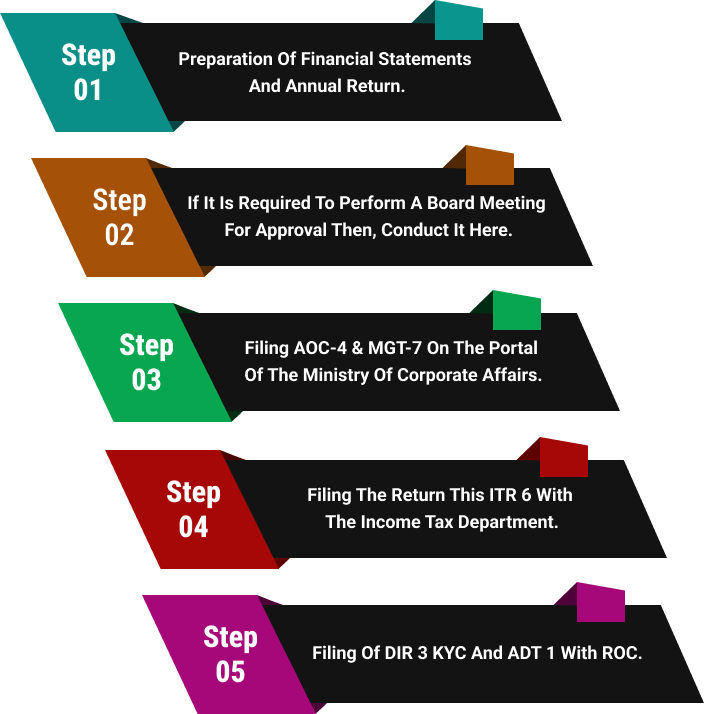

Step 1: Preparation of Financial Statements and Annual Return.

Step 2: If it is required to perform a board meeting for approval then, conduct it here.

Step 3: Filing AOC-4 & MGT-7 on the portal of the Ministry of Corporate Affairs.

Step 4: Filing the return this ITR 6 with the Income Tax Department.

Step 5: Filing of DIR 3 KYC and ADT 1 with ROC.

Such records include Balance Sheet, P&L Account or any other account of that organization or business.

Prepare the Director's Report.

AOC (Annual Return) is filed by the company with the Registrar of Companies (ROC) in Form AOC, 4 within 180 days from the end of the financial year.

Filing of MGT, 7 shall be made electronically with the ROC within 180 days from the financial year, end.

Form ITR-6 is the primary documentation of filing income tax returns for companies.

Any person who wants to become or is a director must fill DIR-3 KYC.

File Form ADT-1 only if relevant.

Our goal at InstabizFilings is to make business solutions more affordable and easily accessible to everyone in India. We have a seasoned group of experts on hand to help you at every stage of your business venture. Having worked with companies of all sizes, from startups to multinational enterprises, for more than 40 years of collective experience, we are experts at streamlining the compliance process and making it less burdensome for business owners.

Although we will definitely take care of the filings on time and provide you with expert advice to help you stay away from fines and be up-to-date with the regulations, the first thing that we want to do is to take the expense report off your hands so that you can have more time to work on the growth of your business. A simplified, stress-free compliance experience with InstabizFilings is something that you can definitely enjoy and it will be instrumental in business continuity.

Are you set to simplify your annual filings? Get started with InstabizFilings today!

Yes, if the OPC’s turnover exceeds INR 1 crore, a statutory audit is mandatory.

No, OPCs are not required to hold AGMs, but they must file annual returns by the due dates.

Form AOC-4: Within 180 days from the end of the financial year (usually by September 27).

Form MGT-7: Within 60 days of the Annual General Meeting or 180 days from the financial year-end for OPCs.

DIR-3 KYC: By September 30 each year.

You need to file Form AOC-4 (financial statements) and Form MGT-7 (annual return) with the ROC. Additionally, Form DIR-3 KYC and income tax returns must be filed.

OPC annual filing is the mandatory submission of financial statements and annual returns to the Registrar of Companies (ROC) every year as per the Companies Act, 2013.

There is a daily penalty of INR 100 for late filing of AOC-4 and MGT-7 forms.

No, OPCs cannot issue shares or convertible instruments but can raise funds through loans or non-convertible debentures.

Documents include the balance sheet, profit and loss account, board report, auditor’s report, director’s KYC, and relevant tax filings.

Yes, all filings with the ROC and Income Tax Department can be done online through the MCA portal.

We handle preparation, certification, and timely filing of all required forms, helping you avoid penalties and compliance hassles.